Tyvixom

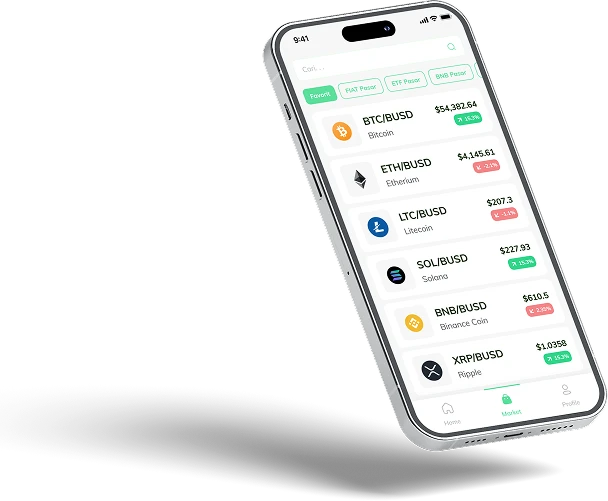

Navigate Crypto Learning Paths with Tyvixom

Tyvixom functions as an access point for those interested in cryptocurrency education, without offering investment guidance, forecasts, or trading plans. Its purpose is to facilitate connections with third party organizations that teach the principles behind digital asset movements and market patterns, helping users discover learning paths tailored to their interests.

During registration, users provide contact information, enabling educational providers to initiate communication. These organizations present their programs, teaching approaches, and general market perspectives. Tyvixom does not evaluate or approve these materials, nor does it guarantee any outcomes from participation.

This intermediary role preserves impartiality in the educational network. Learners are accountable for reviewing content and deciding what is appropriate for them. Because cryptocurrency markets are highly volatile, users should always consider the possibility of financial losses before acting.

Gaining insight into financial markets starts with knowing the forces behind price changes. Investment education emphasizes mastering concepts, familiarizing oneself with industry language, and exploring historical patterns, rather than chasing short term predictions. Such training strengthens the ability to analyze market behavior shaped by policy decisions and world affairs.

Market education sharpens the ability to interpret how economic indicators, narratives, and asset prices influence one another. Even though financial systems carry inherent uncertainty, structured learning helps users make more informed analyses. Instruction typically focuses on comparing data, evaluating risk, and critical reasoning rather than promising predictive certainty.

Analyze trends over the long term to identify meaningful patterns. Participation in courses does not remove volatility or guarantee accurate market insights. Financial markets are continuously shaped by geopolitical events, sentiment changes, and liquidity shifts. The effectiveness of educational content relies on the learner’s level of engagement and analytical approach, and risk remains present despite preparation.

Stay ahead in dynamic market conditions. Tyvixom acts primarily as a connection Site, linking interested participants with appropriate educational providers. The Site does not host courses directly. When users express interest, educators initiate contact, giving learners access to structured programs while the Site preserves neutrality and clarity.

The registration process at Tyvixom acts as a gateway for initiating contact with educational organizations. It is designed purely for outreach purposes and does not provide instructional content or financial recommendations. Required information generally includes a full name for identification, an email for correspondence, and a phone number for follow up communication, ensuring inquiries are properly routed.

Only basic contact details are requested to make the process straightforward. Accurate submission reduces the likelihood of delays or confusion and ensures that educational providers can respond efficiently.

Filling out the registration form does not provide access to courses, investment signals, or guidance. The Site does not evaluate or select providers. Its sole purpose is to connect users with educators, leaving further participation entirely in the user’s hands. Because cryptocurrency markets are highly volatile, thorough research and consultation with professionals are strongly advised before making decisions.

Learning about markets reveals the framework beneath the surface fluctuations. Headlines and volatile price action can trigger urgency, yet deeper exploration demonstrates that markets move in identifiable stages. Strong upward movements followed by corrections have occurred repeatedly, confirming the cyclical behavior of financial systems.

By arranging scattered information into coherent sequences, educational approaches make short term swings easier to contextualize within broader growth and decline cycles. Even though risk remains, methodical review discourages hasty reactions. Historical awareness encourages patience during sudden drops.

Repeated market formations reflect predictable human behaviors. Periods of optimism fuel expansion, caution often precedes contraction, and stabilization brings relief. Studying historical market behavior and economic data exposes these emotional cycles, offering insight beyond superficial trends.

Markets transform over time, but key behavioral tendencies endure. Consistent learning, personal research, and considering multiple viewpoints support informed long term perspectives. Seeking guidance from seasoned financial experts before acting ensures balanced judgment.

Events rarely occur in isolation. Education highlights connections across time, revealing how minor developments can influence outcomes later. Structuring information reduces reactive decisions and provides clarity in complex, dynamic financial environments.

Understanding markets through education reveals how initial signals, often overlooked, fit into larger cyclical trends. Attention moves from fleeting price changes to recurring phases such as accumulation, transition, and periods of imbalance. Even as stories shift rapidly, structural patterns resurface across multiple cycles.

Foundational market activity is typically understated. Quiet intervals with low volume, limited price action, and muted enthusiasm often precede significant moves.

Examining repeated behaviors develops stronger context and insight. Education isn’t about pinpointing exact timing; it equips participants to observe markets with steadiness, relying on reasoned analysis rather than impulsive reactions.

Tyvixom serves as a coordination hub that ensures orderly communication between learners and educators in dynamic markets. It does not host instructional content or deliver financial guidance.

Its primary function is to manage the flow of inquiries, keeping interactions organized while remaining neutral.

Through a structured, tiered system, all incoming inquiries are efficiently sorted and delivered. Educators receive messages exactly as submitted, free from prioritization or bias. Even in volatile market conditions, maintaining a clear process helps participants navigate communication without confusion, providing a stable framework for interaction.

While daily price movements can be distracting, broader market trends have the most lasting impact. Tyvixom supports ongoing dialogue by enabling consistent communication between users and educators. Conversations unfold at a deliberate pace, shaped by the participants’ interest and engagement rather than external urgency.

Market education emphasizes seeing order within apparent chaos. It shifts attention from abrupt price movements to the broader rhythm of market cycles, including phases like accumulation and imbalance. Though narratives and news can change quickly, fundamental patterns tend to persist over time.

By maintaining a strict boundary between providing access and delivering education, the site preserves clarity and avoids exaggerated claims. Market fluctuations do not diminish the need for careful research and questioning. Considering varied viewpoints and seeking professional financial advice before committing supports prudent and balanced decision making.

The purpose of investment education is to illuminate concepts, not to assure outcomes. Engaging with educational content does not automatically lead to correct forecasts or financial gain. Market movements are influenced by psychology, policy shifts, and unforeseen events.

Education aims to deepen comprehension, not to predict the future. Learners may draw different conclusions from the same lesson based on their analytical approach and perspective. Knowledge sharpens insight but cannot provide guaranteed foresight.

Instructors and educational discussions emphasize pattern recognition and historical analysis. They cannot remove uncertainty from markets or dictate future results. Success depends on individual judgment and external factors beyond anyone’s control.

The goal of investment education is to provide clarity on market mechanics, not to promise specific outcomes. Accessing instructional content does not automatically translate into accuracy, profit, or favorable results. Market behavior is influenced by psychology, legal changes, and unpredictable events.

Education adds value by offering structured context. Learners may interpret identical information differently based on their analytical approach and perspective. While education sharpens understanding, it does not grant foresight.

Within educational settings, conversations center on conceptual knowledge, historical patterns, and market behavior. These discussions cannot remove uncertainty or control market trends. Success depends on the learner’s decisions and external conditions.

Markets function on their own, yet education provides a framework for interpreting their movements. In times of sharp fluctuations, informed analysis encourages composure, deliberate evaluation of risk, and a pause before reacting to immediate trends.

Periods of instability demonstrate the value of insight. Education cannot guarantee protection against losses or predict every market event, but it can reduce reactionary decisions driven by fear or hype. The aim is thoughtful judgment rather than following popular sentiment. While exact foresight is impossible, disciplined understanding helps prevent avoidable errors.

Investment education explores key underlying forces such as regulations, capital allocation, and market psychology. Awareness of these repeating influences clarifies why markets cycle through surges, pullbacks, and recoveries. The focus is on interpreting patterns, not forecasting precise outcomes.

The purpose of investment education is to reveal the forces behind market movements, from regulatory shifts to capital trends and collective psychology. These influences work together, moving markets through expansion, pullbacks, and stabilization. Education provides insight into these cycles without guaranteeing outcomes.

Even in unpredictable conditions, education shapes decision making. It fosters patience amid volatility and encourages careful evaluation rather than immediate action. Continuous learning and engagement with diverse viewpoints enhance understanding, while guidance from professional financial advisors supports prudent choices. Cryptocurrency markets remain highly volatile, and users should be aware of the risks of potential losses.

Information collected during registration is intended purely to connect learners with educators. Users’ personal data is protected and never disclosed or sold. Clear boundaries on data use help maintain meaningful and secure educational interactions. Participants should remain mindful of the details they share.

The Site does not host lessons or instructional materials itself. Educators share knowledge and resources through direct communication, typically covering topics like market dynamics, risk management strategies, and historical market patterns.

Content varies with each educator’s focus, from broad macroeconomic trends to detailed technical analysis. Users benefit from considering multiple viewpoints, conducting independent research, and consulting financial advisors to make balanced investment decisions.

Responsible handling of data relies on the user. Limiting shared information to what is relevant and communicating transparently minimizes misunderstandings and fosters productive interactions between learners and educators.

True market insight comes from steady observation over time, not instant reactions. By providing structured access, Tyvixom ensures continuity regardless of shifting market conditions, keeping attention on education rather than immediate noise.

Monitoring broader trends helps clarify decisions when conditions are uncertain. A measured, distanced approach improves understanding and interpretation of market movements.

Registration collects essential contact information so educators can initiate outreach. It does not provide instruction, recommendations, or market analysis.

While emotions always influence decision making, education helps users recognize and moderate their impact during volatile market conditions.

Tyvixom acts as a hub linking individuals to educational providers. It does not give advice or promote specific viewpoints. Its role is strictly to coordinate connections.

| 🤖 Joining Cost | No fees for registration |

| 💰 Operational Fees | No costs whatsoever |

| 📋 Registration Simplicity | Registration is quick and uncomplicated |

| 📊 Focus of Education | Lessons on Cryptocurrencies, Forex Trading, and Investments |

| 🌎 Countries Covered | Excludes the USA, covers most other countries |