Taito Markbit:

Taito Markbit: AI Signals Driving Smarter Market Decisions Daily

Sign up now

Sign up now

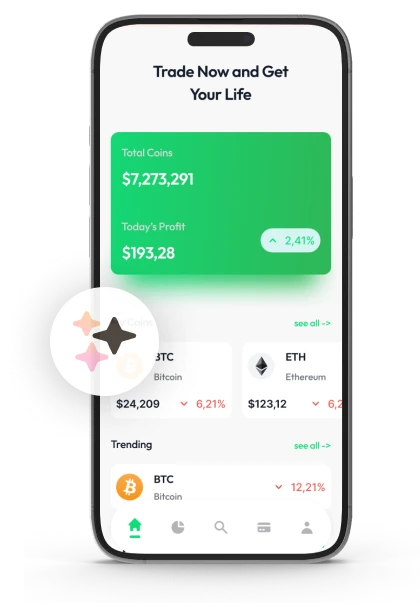

Taito Markbit converts fragmented digital signals into structured situational awareness. It filters accelerated activity, slower cycles, and irregular movement into a unified analytical view, supporting consistent orientation as market dynamics shift. Attention is given to evolving signal cadence to maintain analytical rhythm amid changing conditions.

Using continuous learning across live data streams, Taito Markbit detects developing alignment within periods of volatility. This model stabilizes interpretation during uncertain phases, preserving insight as liquidity flow and directional pressure transition.

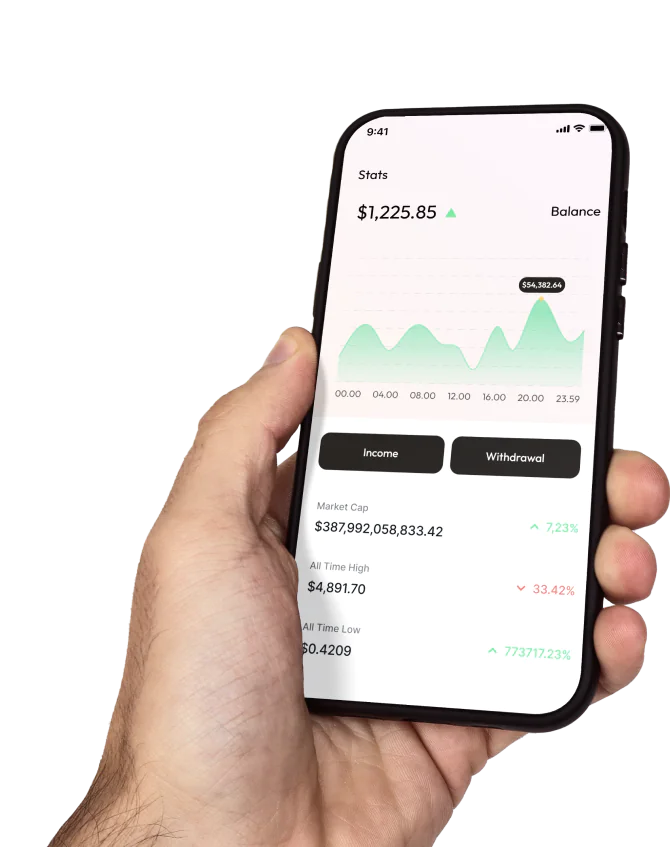

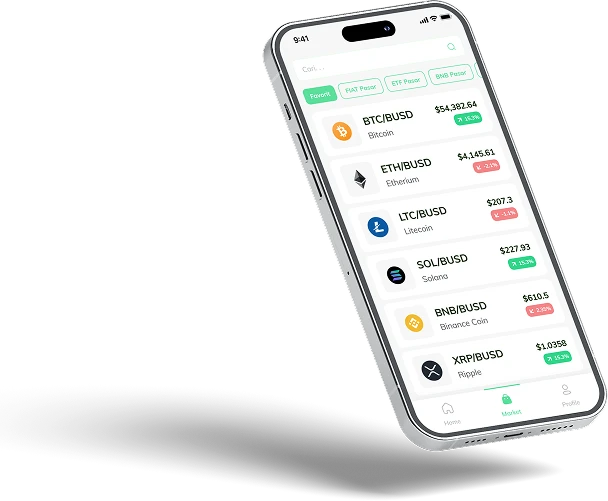

Its adaptive framework organizes fluctuations into defined patterns for efficient analysis. Taito Markbit remains strictly analytical, with no exchange connectivity or transaction capability. The platform delivers continuous monitoring, user friendly interaction, advancing intelligence models, and secure data handling.

Taito Markbit integrates evolving valuation data into continuously updated analytical processes that respond instantly to new inputs. Each signal is subject to structured validation to minimize impulsive bias and preserve interpretive consistency. Archived behavioral sequences support cumulative learning, ensuring assessments remain context aware and historically informed.

Digital asset movement within Taito Markbit is monitored through ongoing adaptive analysis. Transitions are measured for intensity and cadence, converting market variation into structured context that supports timing alignment and proportional assessment. Insight progresses as momentum cycles shift and directional characteristics evolve through systematic identification.

Taito Markbit applies layered analytical logic to register immediate changes and translate them into operational awareness. Continuous comparison between emerging activity and prior structures highlights early alignment shifts. Streamlined guidance reinforces clarity, stability, and adaptive response across changing conditions.

Taito Markbit provides access to structured methodologies informed by cumulative analytical learning. Users maintain complete operational discretion, as adaptive outputs inform behavior without enforcing trade activity. Monitoring systems support sustained focus while internal intelligence assesses macro tendencies and issues contextual notifications. The framework functions as a standalone analytical environment, independent of exchanges and without order execution capability.

Analytical data protection underpins the design of Taito Markbit. The platform operates as a standalone system with no exchange integration or transaction functionality, employing multi layer encoding, access control mechanisms, and continuous verification. All information is retained within a closed, validated infrastructure emphasizing accuracy, confidentiality, and system integrity.

Taito Markbit provides a non directive environment for analytical evaluation. Participants maintain full discretion while specialized tools monitor fine scale reactions and incremental trend development. Through disciplined tracking, emerging signals are identified, quantified, and interpreted with clarity. Cryptocurrency markets are inherently volatile, and financial loss is possible.

Using adaptive analytics, Taito Markbit processes live market behavior as events develop. Each transition is immediately mapped to current conditions. When deviations or uncommon patterns are detected, focused alerts support sustained awareness, enabling structured observation during volatile and evolving market environments.

Within Taito Markbit, analytical processes are designed to limit reactive interpretation and encourage proportional assessment. Layered evaluation replaces speculative response with structured reasoning. Computational filtering organizes complex inputs, isolates relevant movement, and maintains stable reference points, supporting consistent analysis across variable conditions.

Using a modular system design, Taito Markbit adjusts to environmental change while enabling comparative analysis across multiple scenarios. Its internal framework integrates real time data with structured logic to assess underlying behavior. Streamlined transmission preserves clarity and ensures uninterrupted analytical continuity during volatile periods.

Taito Markbit combines archived datasets with live monitoring to analyze recurring volatility characteristics. Extended historical evaluation identifies repeated behavioral traits, sentiment cycles, and structural patterns across digital asset markets. This foundation supports real time interpretation of market response to sudden movement, including accelerations and reversals.

Taito Markbit operates without interruption, tracking shifting variables as they emerge. Intelligent automation reviews volume dynamics in real time, surfacing unusual participation and sentiment movement. Identified changes prompt immediate analysis, preserving measured judgment and flexible interpretation across global activity cycles.

Taito Markbit includes structured assistance to resolve technical issues efficiently and maintain workflow continuity. Guided processes enable clear resolution paths, while adaptive interface design supports consistent oversight for users at varying experience levels. The system operates independently of exchanges, performs no trade execution, and maintains transparency alongside reinforced data protection standards.

Taito Markbit applies persistent observational analysis to identify momentum changes, trend variation, and narrative development. High volume inputs are filtered into concise analytical output during periods of peak relevance. Adaptive algorithms evaluate intensity, detect underlying movement, and locate pressure concentrations, supporting focused interpretation without reliance on reactive behavior during volatility, reduced liquidity, or broad market transitions.

The platform operates independently of exchanges and does not perform trade execution. Taito Markbit provides analytical context only, allowing users to retain full decision control while highlighting inflection levels, strategic alignment zones, and timing windows across low activity and high activity cycles. Analytical discipline is maintained through measured evaluation and factual consistency.

All internal processes within Taito Markbit are secured using encryption and layered verification controls. The system emphasizes structured presentation and accessible design, integrating responsive utilities within a stable framework. Configurable tools and guided interfaces support consistent operational clarity and user confidence under variable market conditions.

Consistent clarity is supported by iterative analytical processes. Taito Markbit applies structured matrices, segmented inputs, and continuous feedback mechanisms to maintain stable evaluation across varying timeframes and extended perspectives. Historical datasets and adaptive visualization tools identify persistent behavioral patterns and reveal inefficiencies in current performance.

Real time analytical systems within Taito Markbit detect variable changes as they occur. Targeted notifications support comparative analysis, progression assessment, and proportional recalibration, enabling objective evolution while preserving adaptability as sentiment cycles and structural conditions reset.

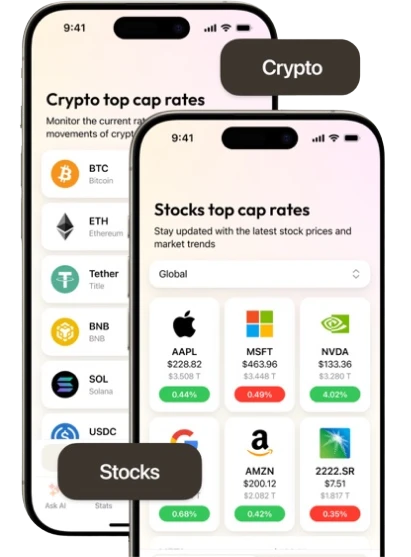

Different time horizons require distinct analytical approaches. Short term conditions necessitate frequent recalibration, while long duration cycles depend on broader context. Taito Markbit integrates both perspectives, generating analytical outputs that support alignment between tactical preference and directional context.

Momentum development is often preceded by concentrated participation. By examining expansion, contraction, and rotation dynamics, Taito Markbit identifies areas of emerging strength and weakening influence. This layered analysis supports anticipation of momentum shifts as leadership transitions across sectors and global market phases.

Effective position oversight relies on defined rules, time boundaries, and measurable limits. Taito Markbit supports this through scenario based evaluation, structured checkpoints, and scheduled review processes. Each adjustment is linked to verified context, supporting stability during both compression and acceleration periods.

Using regime classification and aggregated pattern analysis, Taito Markbit differentiates sustained formations from temporary fluctuations. It evaluates participation levels, correlation behavior, and directional gradients that precede significant transitions. Alerts prompt timely reassessment, allowing benchmarks and reference structures to adjust efficiently. Each review records reasoning, reinforces discipline, and maintains contextual awareness through ongoing rotational environments.

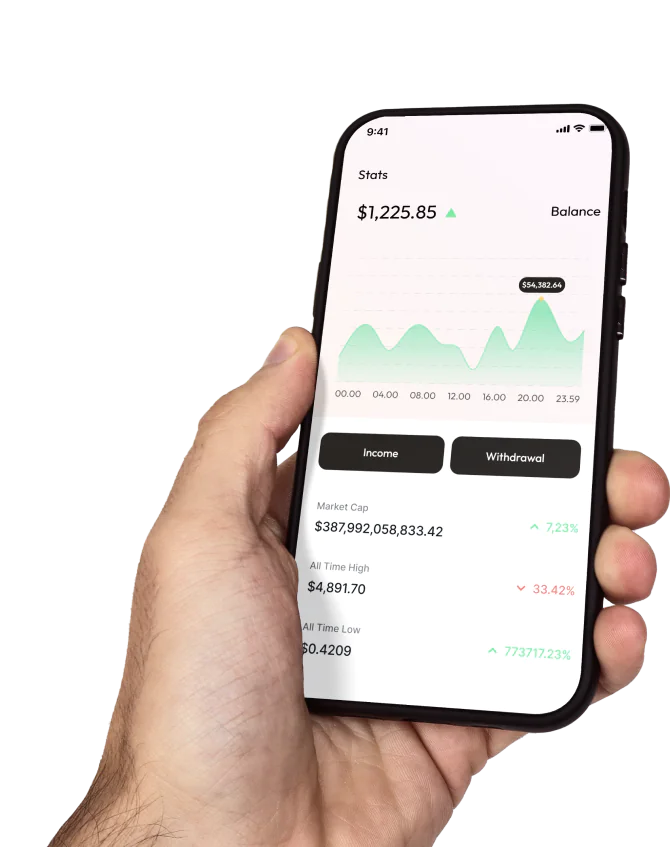

Taito Markbit applies visual analytical tools to represent digital market behavior. Range mapping, momentum evaluation, and cycle indicators describe movement velocity, response thresholds, and directional pressure, supporting situational awareness and short horizon interpretation.

Range based analysis identifies pressure boundaries, momentum metrics assess strength and trend development, and oscillation monitoring detects impulse decay. Automated refinement processes enhance precision, aligning evaluation with observable metrics rather than short term volatility.

Through the removal of overlapping signals, Taito Markbit maintains distinct structural interpretation. Structured review processes, segmented validation, and organized feedback mechanisms improve timing and sequence clarity. This methodology supports consistent interpretation through ongoing contextual alignment.

Shifts in perception can precede observable confirmation. Taito Markbit aggregates and analyzes social discourse, informational reports, and commentary streams to produce condensed sentiment indicators that minimize distortion and emphasize key influences.

Its analytical engine processes extensive datasets to identify early changes in emotional bias. Increasing positive tone may indicate strengthening participation, while declining sentiment can suggest reduced engagement across liquidity transitions, session overlap, and broader cyclical movement.

This sentiment evaluation complements structural analysis within Taito Markbit. By examining behavioral tone across multiple sources, the system identifies contrast, equilibrium, and directional bias, converting narrative information into contextual insight and supporting disciplined interpretation during fluctuating conditions.

Macroeconomic events, including fiscal policy updates, interest rate adjustments, and labor market releases, can influence cryptocurrency valuation dynamics. Taito Markbit applies AI supported macro analysis to assess how these factors impact asset orientation, particularly during policy compression phases associated with decentralized allocation, institutional flow adjustment, and sentiment divergence across global markets.

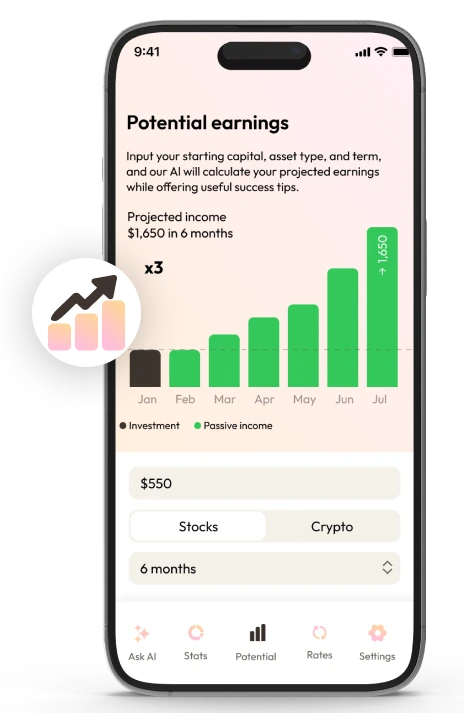

Policy transitions often generate sustained effects. By integrating archived trend behavior with current momentum data, Taito Markbit develops analytical projections designed to support stability through volatility, reversals, and extended periods of uncertainty within evolving digital markets.

Market behavior can reflect underlying timing variations not immediately visible. Taito Markbit combines extended analytical models with real time evaluation to compare asset movement against technical structure. This creates defined review intervals for structured analysis and planning across variable liquidity conditions.

Through adaptive system design, Taito Markbit identifies rhythmic sequences, recurring structural patterns, and phase transitions. These insights clarify timing relationships that influence performance during volatility, reversals, and complex market states.

Layered diversification reduces reliance on single variables. Taito Markbit applies AI supported correlation analysis to model portfolio behavior under simulated stress, identifying convergence and divergence characteristics among assets as pressure increases.

Taito Markbit minimizes analytical distortion to identify developing directional bias at an early stage. Indicators such as acceleration changes, compression zones, and stress markers are detected prior to broad recognition, supporting structured response planning.

Momentum accumulation may occur beneath low visibility conditions. Taito Markbit evaluates pressure dynamics to distinguish active movement from background variation, supporting focused interpretation based on verified signals.

Using AI assisted diagnostic models, Taito Markbit evaluates rapid accelerations, concealed retracements, and irregular volatility behavior. These observations reorganize complex data into structured context, supporting informed interpretation and disciplined observation.

Taito Markbit integrates accelerated data evaluation with structured analytical models to support clarity in volatile market environments. Incoming datasets are segmented, processed, and converted into structured insight identifying velocity changes, cyclical patterns, and systemic balance points.

Configured through participant defined parameters, Taito Markbit adapts to changing conditions. Each update reflects live variability while maintaining analytical integrity, logical consistency, and stable reference orientation across unstable periods.

Taito Markbit applies machine learning techniques to process extensive datasets into structured analytical layers. The system identifies low visibility behavioral indicators within noisy data, isolating relevant variables prior to aggregation. This approach converts complexity into organized insight, supporting clear and methodical analysis.

The platform is designed for broad accessibility. Taito Markbit employs an adaptive interface that reduces analytical friction and organizes complex market cycles into coherent views. This structure supports understanding, consistency, and orientation regardless of prior analytical experience.

Taito Markbit operates as a standalone analytical system with no exchange integration and no transaction execution capability. This independence ensures impartial analysis. All analytical processes are intended to provide context and situational awareness rather than directive conclusions, supporting structured interpretation across varying market conditions.

| 🤖 Entry Fee | No entrance fee |

| 💰 Incurred Costs | Free of any charges |

| 📋 Process of Joining | Registration is streamlined and fast |

| 📊 Subjects Covered | Education on Crypto assets, Forex markets, and Investment strategies |

| 🌎 Eligible Countries | Almost all countries are supported except the US |